exit short trade. Momentum shifting to the upside

Status: Exit at 9599

Result: +82 pips

Thursday, December 21, 2006

Wednesday, December 20, 2006

Holding the Cable Short

Tuesday, December 19, 2006

Shorting the Cable

Monday, December 18, 2006

Momentum in favor of the GBP

Notice that momentum has been towards the downside of the Cable and that the trend strength is picking up. Today would be a good day to go short but my chart shows that price is resting on support right now. My gut tells me that the pair will still fall, but I want to wait for confirmation. If the momentum continues and the pair breaks its support, I may enter short tomorrow.

Status: Waiting to attack

Sunday, December 17, 2006

Big Pippin's Pipnals

Alright, so I'm going to start something new. I've been backtesting a strategy and so far it seems to be working out pretty well. As a result, I am now at the forward testing stage. I've gone back and tested 6 months of data from February to August 2006 and in 6 months time the system pulled in 516 pips. I tried to pick a choppy time in the market so I could see if the system could withstand the normal range bound environment and at the same I wanted the system to still be profitable in the rare trending environments.

Although I'm not going to reveal the system, I can give you general information on it. The system is a momentum catching system which also attempts to measure the strength of the momentum. When I see a momentum move, I look at the strength and if I see that the strength is building, I enter the market. I exit when I see the momentum strength dip too low because it's basically telling me that the trend may be over.

I tested this system again from September to the current date and the system pulled in 996 pips. There were only 12 trades and the system gave a 58% win ratio. My average win was 194 pips and my average loss was -73 pips. Max drawdown was -192 pips and my max win streak was 593 pips. From September to November we had more of a trending environment which is why the pip gain was higher. So from my testing so far it seems like the system does well in both market environments.

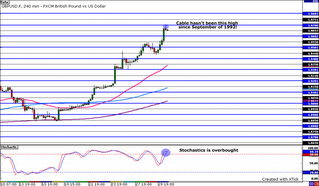

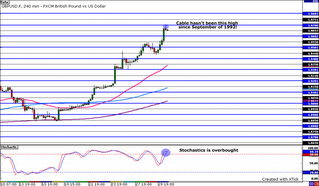

So I will post my momentum charts as well as my trend strength charts. I am only trading the Cable for now and I trade off of a daily chart. You can see from my results that there aren't that many trades but I like that because it keeps me from having to stare at charts all day. Below are what my momentum and trend strength charts look like:

So you can see that I try to enter when I see momentum rising and trend strength gaining. I exit when trend strength drops too low. I will post a chart like this everyday so you can see where momentum and trend strength are at that current time. One rule I have is that I won't enter or hold a trade before the weekend because there is too much risk of something happening and me not being able to do anything until the market re-opens. I usually will have a trade on Monday or Tuesdays and hold it until the end of the week.

Well I think thats pretty much everything I can say about it now. I hope the forward tests work as well as my back tests. I am going to make this a 6 month project. If I'm happy with the results then I'll continue forward. If not, then it's back to the drawing board! Wish me luck!

Although I'm not going to reveal the system, I can give you general information on it. The system is a momentum catching system which also attempts to measure the strength of the momentum. When I see a momentum move, I look at the strength and if I see that the strength is building, I enter the market. I exit when I see the momentum strength dip too low because it's basically telling me that the trend may be over.

I tested this system again from September to the current date and the system pulled in 996 pips. There were only 12 trades and the system gave a 58% win ratio. My average win was 194 pips and my average loss was -73 pips. Max drawdown was -192 pips and my max win streak was 593 pips. From September to November we had more of a trending environment which is why the pip gain was higher. So from my testing so far it seems like the system does well in both market environments.

So I will post my momentum charts as well as my trend strength charts. I am only trading the Cable for now and I trade off of a daily chart. You can see from my results that there aren't that many trades but I like that because it keeps me from having to stare at charts all day. Below are what my momentum and trend strength charts look like:

So you can see that I try to enter when I see momentum rising and trend strength gaining. I exit when trend strength drops too low. I will post a chart like this everyday so you can see where momentum and trend strength are at that current time. One rule I have is that I won't enter or hold a trade before the weekend because there is too much risk of something happening and me not being able to do anything until the market re-opens. I usually will have a trade on Monday or Tuesdays and hold it until the end of the week.

Well I think thats pretty much everything I can say about it now. I hope the forward tests work as well as my back tests. I am going to make this a 6 month project. If I'm happy with the results then I'll continue forward. If not, then it's back to the drawing board! Wish me luck!

Friday, December 08, 2006

Blog Has Moved

Hello everyone. As you know I have moved my posts and am now posting at BabyPips.com. I am very excited because we have just launched our new Version 2 which has many cool new features. Here are just some of the new additions to the site:

- The much anticipated College Lessons

- Interactive quizzes after each lesson

- New Forex Blogs (including mine)

- New Forex Forums

- ForexPedia (a massive Forex encyclopedia)

The site allows for more interactivity between traders and I hope you can be a part of this awesome community. Together we can share ideas and synergize our efforts to become the most bad-azz traders in the Forex :)

Happy trading everyone!

- The much anticipated College Lessons

- Interactive quizzes after each lesson

- New Forex Blogs (including mine)

- New Forex Forums

- ForexPedia (a massive Forex encyclopedia)

The site allows for more interactivity between traders and I hope you can be a part of this awesome community. Together we can share ideas and synergize our efforts to become the most bad-azz traders in the Forex :)

Happy trading everyone!

Tuesday, December 05, 2006

Pippin Aint Easy Is Moving!

Hello everyone,

Starting December 4, 2006, I will be moving locations. From now on you can find my posts at:

http://www.babypips.com/blogs/pippinainteasy/

Thank you for all your support and I hope to see you at my new home.

Happy trading!

-BP

PS: If you have a trading blog and would like to be added to my linkroll, send me an email at bigpippin (at) babypips (dot) com. I will only link you if you are a legitimate trading blog. No vendors will be allowed.

Starting December 4, 2006, I will be moving locations. From now on you can find my posts at:

http://www.babypips.com/blogs/pippinainteasy/

Thank you for all your support and I hope to see you at my new home.

Happy trading!

-BP

PS: If you have a trading blog and would like to be added to my linkroll, send me an email at bigpippin (at) babypips (dot) com. I will only link you if you are a legitimate trading blog. No vendors will be allowed.

Thursday, November 30, 2006

Thursday, November 30, 2006

My suspicions were correct about the Dollar not being done taking its beating. After some profit taking yesterday, the Dollar once again resumed its meltdown as it plummeted agains the 4 majors today. The main reason for the drop? More bad economic releases for the US. The job market, which was once strong, is now starting to look like it may have some weakness as unemployment claims unexpectedly rose. To top it off, the Chicago PMI contracted below 50 which is the first time it has done that since April 2003.

In my opinion, a new trend is in place. For a few weeks now my weekly Bias-O-Meter has been screaming signs for a bearish dollar and it is finally starting to happen. I don't even think a positive US news report can save the Dollar anymore. I expect the Dollar to continue this down trend throughout Q1. We may see some profit taking and retracements but the general direction for the dollar for the next few months is DOWN.

I'll go as far to say that even Bernanke himself won't be able to bring the dollar back up. He can scream his inflation talk all he wants but I think the market is smart enough to see that from the economic data, the next move for the Fed is a rate cut. Interesting enough, he is speaking tomorrow so I can test my bold theory out. We could see some profit taking if he really harps on inflation but the overall medium term is going to be dollar bearish.

Coming Up:

Bernanke Speaks

9:00 am ET; 14:00 GMT

ISM Manufacturing Index

10:00 am ET; 15:00 GMT

Previous= 51.2; Forecast= 52

Chart Analysis:

EUR/USD

The technicals were once again overrun by the fundamental reports today. As usual, the technicals are still showing that the EUR/USD is overbought. 4hr stochastics overbought and the daily stochastics is overbought. The thing is, there isn't really a major resistance level until 3400ish. So while we may see some slight retracements, the Euro is showing poise to climb up to 3400 and maybe even 3500. As for the short term? I have no clue. Technicals say the pair will move down, but fundamentally, I don't see anything to stop the dollar from continuing its downfall.

GBP/USD

The Cable is at a ridiculously high level right now hovering around 9660. I scrolled back my chart to see when the last time the Cable was at this level and wow! I had to keep scrolling and scrolling and scrolling until I got to September of 1992! Can you believe that? The Cable has not been this high in 15 years! So what is to keep this pair from stopping? Well nothing that I can see except for the fact that this is a very extreme level and I'm just curious to see if the Cable can hold at such a high rate. Technicals are showing signs for a retracement (figures!) but with all the fundamental rucks the dollar has been facing, who knows how high this pair could go.

USD/CHF

The Swissy is at what I think is good support. It's currently hovering around 1950 which hasn't been reached since May. The pair could bounce up from there especially since the technicals support an upward move but the Euro and Cable don't show signs of slowing down so I'm not 100% confident about this. If it does bounce up, look for a move towards its 50 SMA on the 4hr chart.

USD/JPY

Out of all the majors, the Yen is the only one that moved according to its technicals. Like clockwork, the pair bounced down from its 4hr 50 SMA and moved to 115.50. Unlike the other pairs that saw huge gains against the dollar, the Yen stayed relatively quiet. The pair is showing signs for another move up and a suitable target looks to be the 4 hr 50 SMA again.

Conclusion:

This week has been another can of "whoop ass" for the dollar and with so many negative fundamental reports for the US, I don't see anything to stop the dollar from tumbling. As always, I could be wrong, but from what I see, I think think the dollar is in for some gloom throughout the rest of the year and Q1.

In my opinion, a new trend is in place. For a few weeks now my weekly Bias-O-Meter has been screaming signs for a bearish dollar and it is finally starting to happen. I don't even think a positive US news report can save the Dollar anymore. I expect the Dollar to continue this down trend throughout Q1. We may see some profit taking and retracements but the general direction for the dollar for the next few months is DOWN.

I'll go as far to say that even Bernanke himself won't be able to bring the dollar back up. He can scream his inflation talk all he wants but I think the market is smart enough to see that from the economic data, the next move for the Fed is a rate cut. Interesting enough, he is speaking tomorrow so I can test my bold theory out. We could see some profit taking if he really harps on inflation but the overall medium term is going to be dollar bearish.

Coming Up:

Bernanke Speaks

9:00 am ET; 14:00 GMT

ISM Manufacturing Index

10:00 am ET; 15:00 GMT

Previous= 51.2; Forecast= 52

Chart Analysis:

EUR/USD

The technicals were once again overrun by the fundamental reports today. As usual, the technicals are still showing that the EUR/USD is overbought. 4hr stochastics overbought and the daily stochastics is overbought. The thing is, there isn't really a major resistance level until 3400ish. So while we may see some slight retracements, the Euro is showing poise to climb up to 3400 and maybe even 3500. As for the short term? I have no clue. Technicals say the pair will move down, but fundamentally, I don't see anything to stop the dollar from continuing its downfall.

GBP/USD

The Cable is at a ridiculously high level right now hovering around 9660. I scrolled back my chart to see when the last time the Cable was at this level and wow! I had to keep scrolling and scrolling and scrolling until I got to September of 1992! Can you believe that? The Cable has not been this high in 15 years! So what is to keep this pair from stopping? Well nothing that I can see except for the fact that this is a very extreme level and I'm just curious to see if the Cable can hold at such a high rate. Technicals are showing signs for a retracement (figures!) but with all the fundamental rucks the dollar has been facing, who knows how high this pair could go.

USD/CHF

The Swissy is at what I think is good support. It's currently hovering around 1950 which hasn't been reached since May. The pair could bounce up from there especially since the technicals support an upward move but the Euro and Cable don't show signs of slowing down so I'm not 100% confident about this. If it does bounce up, look for a move towards its 50 SMA on the 4hr chart.

USD/JPY

Out of all the majors, the Yen is the only one that moved according to its technicals. Like clockwork, the pair bounced down from its 4hr 50 SMA and moved to 115.50. Unlike the other pairs that saw huge gains against the dollar, the Yen stayed relatively quiet. The pair is showing signs for another move up and a suitable target looks to be the 4 hr 50 SMA again.

Conclusion:

This week has been another can of "whoop ass" for the dollar and with so many negative fundamental reports for the US, I don't see anything to stop the dollar from tumbling. As always, I could be wrong, but from what I see, I think think the dollar is in for some gloom throughout the rest of the year and Q1.

Wednesday, November 29, 2006

Wednesday, November 29, 2006

The dollar made a little bit of a comeback but I'm not fully convinced that this is a true reversal.....YET! Sure the GDP came out higher than expected but New Home Sales dropped so the dollar is still not out of the mud. Today's dollar gain looks more like some profit taking by the sellers over the Thanksgiving holiday. We only saw a slight retracement in the majors and I'm not fully convinced the dollar is done dropping.

The Beige Book stated the obvious. There is moderate economic growth and housing sucks. Boring...we know this already. I think this is why the market didn't really react to this. The report did say that the labor market is getting tight in some regions so this could be another potential pitfall for the Dollar once the NFP rolls around. Just something to think about.

One thing I do want to note is that this retracement came in line with my technical analysis I had been doing the past couple of days. I saw bearish divergences on both the Euro and Cable and now those moves have taken place. It's still not clear where the dollar is going to go the rest of this week because the technicals still aren't giving any strong indications on the dollar's next direction. Once again we have a slew of economic reports for both the Euro, Pound, and Dollar so movement will be very dependent on these numbers. If we see good numbers for the Euro and Pound, and weak numbers for the Dollar, expect the dollar to lose big again. However, if the opposite is true, look for the dollar to add on to the ground it made up today.

Coming Up:

EUR CPI

5:00 am ET; 10:00 GMT

Previous= 1.6%; Forecast= 1.9%

EUR Consumer Confidence

5:00 am ET; 10:00 GMT

Previous= -7; Forecast= -8

EUR GDP

5:00 am ET; 10:00 GMT

Previous= 0.9%; Forecast= 0.5%

GBP Consumer Confidence

5:30 am ET; 10:30 GMT

Previous= -5; Forecast= -5

US Personal Spending

8:30 am ET; 13:30 GMT

Previous= 0.1%; Forecast= 0.1%

US Core PCE Index

8:30 am ET; 13:30 GMT

Previous= 0.2%; Forecast= 0.2%

US Chicago PMI

10:00 am ET; 15:00 GMT

Previous= 53.5; Forecast= 55

Chart Analysis:

EUR/USD

The Euro finally found resistance at 3200 but with only a 50 pip retracement I'm not sure if this pair is done moving up. 4hr stochastics shows that there is still room for downward movement and we could see it reach 3100 or possibly even down to its 50 SMA. Tomorrow's move is going to be very data dependent so I'm not placing too much emphasis on the chart at this point. Technicals say the pair is going down but it's not giving me a resounding answer.

GBP/USD

It's the same story with the Cable as the Euro. The pair found resistance at 9550 and retraced slightly to 9450. Yes I know...it's 100 pips, but with the Cable, trust me...that's not that much of a move. 4hr stochastics is showing even more room for selling than the Euro's 4hr stochastics so I could see the pair dropping another 100 pips to 9350 and it could also possibly reach its 50 SMA.

USD/CHF

The Swissy is "chillin out, maxin, relaxin, all cool and all..." at around 2100 right now. (*If you can guess what song that quote came from, you are super cool in my book) The 50 SMA is fast approaching the pair and could be the next resistance level although the 4hr stochastics is already hovering into overbought territory. Technically speaking, 2150 looks like an appropriate target for the Swissy in the near future.

USD/JPY

The Yen is the lone ranger out of the 4 majors today. Unlike the other 3 pairs which show a little more room to continue its current direction, the Yen is already at a solid resistance level. The pair is right at its 50 SMA on the 4hr chart and stochastics is almost in the overbought territory. So I see 2 possible scenarios. The first is that the pair bounces down from where its at right now OR the pair follows the trend of the other 3 pairs and continues to move up to its 100 SMA before bouncing back down.

Conclusion:

It will be another data dependent day tomorrow with the plethora of news reports due out. Today's market actions remind me of how I felt when I was 14 on my first date with a girl....unsure and reluctant! Tomorrow's news should give traders enough indication whether or not they should hold onto their dollars or sell them like hotcakes. Happy trading everyone!

The Beige Book stated the obvious. There is moderate economic growth and housing sucks. Boring...we know this already. I think this is why the market didn't really react to this. The report did say that the labor market is getting tight in some regions so this could be another potential pitfall for the Dollar once the NFP rolls around. Just something to think about.

One thing I do want to note is that this retracement came in line with my technical analysis I had been doing the past couple of days. I saw bearish divergences on both the Euro and Cable and now those moves have taken place. It's still not clear where the dollar is going to go the rest of this week because the technicals still aren't giving any strong indications on the dollar's next direction. Once again we have a slew of economic reports for both the Euro, Pound, and Dollar so movement will be very dependent on these numbers. If we see good numbers for the Euro and Pound, and weak numbers for the Dollar, expect the dollar to lose big again. However, if the opposite is true, look for the dollar to add on to the ground it made up today.

Coming Up:

EUR CPI

5:00 am ET; 10:00 GMT

Previous= 1.6%; Forecast= 1.9%

EUR Consumer Confidence

5:00 am ET; 10:00 GMT

Previous= -7; Forecast= -8

EUR GDP

5:00 am ET; 10:00 GMT

Previous= 0.9%; Forecast= 0.5%

GBP Consumer Confidence

5:30 am ET; 10:30 GMT

Previous= -5; Forecast= -5

US Personal Spending

8:30 am ET; 13:30 GMT

Previous= 0.1%; Forecast= 0.1%

US Core PCE Index

8:30 am ET; 13:30 GMT

Previous= 0.2%; Forecast= 0.2%

US Chicago PMI

10:00 am ET; 15:00 GMT

Previous= 53.5; Forecast= 55

Chart Analysis:

EUR/USD

The Euro finally found resistance at 3200 but with only a 50 pip retracement I'm not sure if this pair is done moving up. 4hr stochastics shows that there is still room for downward movement and we could see it reach 3100 or possibly even down to its 50 SMA. Tomorrow's move is going to be very data dependent so I'm not placing too much emphasis on the chart at this point. Technicals say the pair is going down but it's not giving me a resounding answer.

GBP/USD

It's the same story with the Cable as the Euro. The pair found resistance at 9550 and retraced slightly to 9450. Yes I know...it's 100 pips, but with the Cable, trust me...that's not that much of a move. 4hr stochastics is showing even more room for selling than the Euro's 4hr stochastics so I could see the pair dropping another 100 pips to 9350 and it could also possibly reach its 50 SMA.

USD/CHF

The Swissy is "chillin out, maxin, relaxin, all cool and all..." at around 2100 right now. (*If you can guess what song that quote came from, you are super cool in my book) The 50 SMA is fast approaching the pair and could be the next resistance level although the 4hr stochastics is already hovering into overbought territory. Technically speaking, 2150 looks like an appropriate target for the Swissy in the near future.

USD/JPY

The Yen is the lone ranger out of the 4 majors today. Unlike the other 3 pairs which show a little more room to continue its current direction, the Yen is already at a solid resistance level. The pair is right at its 50 SMA on the 4hr chart and stochastics is almost in the overbought territory. So I see 2 possible scenarios. The first is that the pair bounces down from where its at right now OR the pair follows the trend of the other 3 pairs and continues to move up to its 100 SMA before bouncing back down.

Conclusion:

It will be another data dependent day tomorrow with the plethora of news reports due out. Today's market actions remind me of how I felt when I was 14 on my first date with a girl....unsure and reluctant! Tomorrow's news should give traders enough indication whether or not they should hold onto their dollars or sell them like hotcakes. Happy trading everyone!

Tuesday, November 28, 2006

Tuesday, November 28, 2006

The dollar took another beating today as all the US fundamentals came out negative and confirmed the notion that the dollar's rise is over. Durable goods and Core Durable goods both came out lower than expected and housing prices fell for the 3rd straight month (Interestingly enough, existing home sales went up which means we have some discount buyers out there). Right now everything is looking gloomy for the dollar and there might not be much that can keep it from falling.

It's funny because usually when the Euro appreciates against the dollar very fast, the ECB officials will start to talk the Euro back down. This is not the case this time which can only add more doom and gloom for the mighty Greenback.

Even Triple B himself, (Bernanke for those of you who aren't up on the street jive), couldn't slow down the dollar slump with his statements today. He said in a statement that inflation risks are "primarily to the upside". The market doesn't seem to buy that anymore and even with that, they still don't believe the Fed will have to increase rates to cut down inflation. In fact, traders are placing their bets that the Fed is going to cut their rates in March of 2007. This Thanksgiving move could be the beginning of the dollar's demise. MWUAHAHAHAHA! (Sorry, an evil laugh just sounded good after I used the word "demise")

Kathy Lien over at FXCM said that the majors made a similar rally against the buck last Thanksgiving but that it corrected itself the Monday after the holiday. This time around however, the markets have actually gone with the flow which to me, signals that traders are actually thinking the same way for a change.

Coming Up:

US GDP

8:30 am ET; 13:30 GMT

Previous= 1.6%; Forecast= 1.8%

US New Home Sales

10:00 am ET; 15:00 GMT

Previous= 1.08M; Forecast= 1.02M

US Beige Book

2:00 pm ET; 19:00 GMT

This could be significant because it will give us a look at how the different Fed branches view the US economy right now.

Chart Analysis:

EUR/USD

With another Euro rally today, our regular bearish divergence I saw yesterday has now been voided because stochastics is now higher than it was at the previous swing high. However, the 4hr chart is now forming a regular bearish divergence which still leads me to believe that the pair could head down. This has been the longest Euro rally against the dollar in a long time so I'm thinking this pair is bound to retrace but it will all depend on the economic data coming out tomorrow. What I want to wait for now is the 4hr stochastics to start reversing down. If I see this then I will start to look for a short entry point. Right now however, the direction is still blurry until the fundamentals are released tomorrow.

GBP/USD

There is still a slight hint of a regular bearish divergence on the daily chart of the Cable. The Cable has not reached 9500 since December 15, 2004! This is an extremely high level right now for the pair and I'm not sure if it can sustain it. The technicals are showing signs for a reversal but again, it will depend on the fundamentals tomorrow. It's a very tricky time right now because we need to find out if there is enough fundamental juice to continue to fuel this rally. Tomorrow should give us a better picture.

USD/CHF

The Swissy is still holding support at 2000. Unlike the Euro and Cable, the Swissy didn't gain any new ground against the dollar. The next move will be dependent on tomorrows news reports. Today was pretty much a range day for this pair.

USD/JPY

The Yen is still holding support at its 200 SMA on the daily chart. Today's candle was a spinning top and could be a sign of a reversal. Daily stochastics is reading oversold so there are good technical reasons to believe that this pair will head up in the near future.

Conclusion:

Tomorrow's fundamentals will play an important role in the dollar's fate tomorrow. We've seen the dollar take quite a beating these past few days and now the tricky part is deciding whether not the market will continue the trend or correct itself. Be very careful if you are trading at this point. I know I will be!

It's funny because usually when the Euro appreciates against the dollar very fast, the ECB officials will start to talk the Euro back down. This is not the case this time which can only add more doom and gloom for the mighty Greenback.

Even Triple B himself, (Bernanke for those of you who aren't up on the street jive), couldn't slow down the dollar slump with his statements today. He said in a statement that inflation risks are "primarily to the upside". The market doesn't seem to buy that anymore and even with that, they still don't believe the Fed will have to increase rates to cut down inflation. In fact, traders are placing their bets that the Fed is going to cut their rates in March of 2007. This Thanksgiving move could be the beginning of the dollar's demise. MWUAHAHAHAHA! (Sorry, an evil laugh just sounded good after I used the word "demise")

Kathy Lien over at FXCM said that the majors made a similar rally against the buck last Thanksgiving but that it corrected itself the Monday after the holiday. This time around however, the markets have actually gone with the flow which to me, signals that traders are actually thinking the same way for a change.

Coming Up:

US GDP

8:30 am ET; 13:30 GMT

Previous= 1.6%; Forecast= 1.8%

US New Home Sales

10:00 am ET; 15:00 GMT

Previous= 1.08M; Forecast= 1.02M

US Beige Book

2:00 pm ET; 19:00 GMT

This could be significant because it will give us a look at how the different Fed branches view the US economy right now.

Chart Analysis:

EUR/USD

With another Euro rally today, our regular bearish divergence I saw yesterday has now been voided because stochastics is now higher than it was at the previous swing high. However, the 4hr chart is now forming a regular bearish divergence which still leads me to believe that the pair could head down. This has been the longest Euro rally against the dollar in a long time so I'm thinking this pair is bound to retrace but it will all depend on the economic data coming out tomorrow. What I want to wait for now is the 4hr stochastics to start reversing down. If I see this then I will start to look for a short entry point. Right now however, the direction is still blurry until the fundamentals are released tomorrow.

GBP/USD

There is still a slight hint of a regular bearish divergence on the daily chart of the Cable. The Cable has not reached 9500 since December 15, 2004! This is an extremely high level right now for the pair and I'm not sure if it can sustain it. The technicals are showing signs for a reversal but again, it will depend on the fundamentals tomorrow. It's a very tricky time right now because we need to find out if there is enough fundamental juice to continue to fuel this rally. Tomorrow should give us a better picture.

USD/CHF

The Swissy is still holding support at 2000. Unlike the Euro and Cable, the Swissy didn't gain any new ground against the dollar. The next move will be dependent on tomorrows news reports. Today was pretty much a range day for this pair.

USD/JPY

The Yen is still holding support at its 200 SMA on the daily chart. Today's candle was a spinning top and could be a sign of a reversal. Daily stochastics is reading oversold so there are good technical reasons to believe that this pair will head up in the near future.

Conclusion:

Tomorrow's fundamentals will play an important role in the dollar's fate tomorrow. We've seen the dollar take quite a beating these past few days and now the tricky part is deciding whether not the market will continue the trend or correct itself. Be very careful if you are trading at this point. I know I will be!

Monday, November 27, 2006

Monday, November 27, 2006

So there I was, stuffing my stomach with deep fried turkey, mac and cheese, succulent ham and all the other fixins and all the while the market was making huge moves. The last thing I said before I left was that I seriously doubted that the markets would move. Boy was I ever wrong! That just goes to show you that you should never completely "listen" to me. I mean sure, I am the best looking member of the FX-Men and many times it seems like I have superhuman abilities to foresee the market, but at the end of the day, I'm just a handsome analyst who makes a best guess decision on market movements based on what I see is going on around me. :)

Ok so what's the deal with the crazy move? Let's see....The French said business confidence was at its strongest levels in 5 years. Being that the French make up the 2nd largest economy for the Euro-Zone, this is pretty big. To add to the Euro fuel, German business confidence surprisingly jumped to a 15 year high! So can someone say interest rate hike? Apparently that's exactly what the few traders that traded over the holidays were saying as they sold off the dollar and drove the Euro and Pound to new highs.

Now before you go and join the crowd, consider this: Volume was very thin over the holidays and as a result there was no one to sell against the rising Euro and Cable. I think we'll see a correction during the course of this week. We are already starting to see some of the retracement and I expect that we'll see more counter movement throughout the week.

On the US front, shopping was crazy throughout this weekend. The word on the street is that consumer shopping has started off on a strong note and could be indicative of a good shopping season. This strong spending will cause a spike in Retail Sales and Consumer Spending especially since salaries have been growing. People have money in their pockets and they're not afraid to use it!

Weekly Bias-O-Meter:

My Bias-O-Meter is still showing a dollar negative trend. It's been like this for 4 straight weeks now.

EUR/USD; GBP/USD= Bullish

USD/CHF; USD/JPY= Bearish

Coming Up:

US Durable Goods

8:30 am ET; 13:30 GMT

Previous= .5%; Forecast= .4%

Consumer Confidence

10:00 am ET; 15:00 GMT

Previous= 105.4; Forecast= 106.4

Existing Home Sales

10:00 am ET; 15:00 GMT

Previous= 6.18M; Forecast= 6.20M

Chart Analysis:

EUR/USD

Whatever the Euro has been doing over the holidays has caused my oscillator to show extreme levels. As a result, I see REVERSAL opportunities. The 4hr stochastics has shown overbought since last Tuesday and the daily stochastics is also in overbought territory. I'm starting to see the formation of a regular bearish divergence on the daily chart so there's a good chance the next move is down. The trick now is to find a suitable entry point. I'm going to hold off until the fast stochastic line actually crosses down below the slow stochastic line.

GBP/USD

Like the Euro, the Cable is telling a similar story. 4 hr stochastics has been showing overbought since Monday of last week and we're now starting to see the formation of a regular hidden divergence on the daily chart. Again, the trick is finding a good entry point and I will also hold off on this one until the fast stochastic line crosses below the slower stochastic line.

USD/CHF

The Swissy has found support at 2000. The pair has been in oversold territory on the 4hr chart since last Tuesday and it looks like a reversal is a good possibility. Unlike the Euro and Cable which are showing divergences, the Swissy is not showing any kind of divergence but its daily stochastics is in oversold territory and looks to be heading back up.

USD/JPY

The Yen got as low as 115.50 and looks to have found support there. Currently it's right at 116.00 and seems to have found new support at the 200 SMA on the daily chart. The 4 hr stochastics has been moving up so it's hard to say whether or not the pair will continue to move up or if it will reverse back down. Things are kind of tricky right now since the holiday trading kind of made the market movements a little weird.

Conclusion:

Thanksgiving trading really threw a bone at the market as the low volume of traders forced the market in a lopsided direction. Now that the rest of the world is back in the market, it will be interesting to see what happens. My personal opinion is that last week's move will be corrected this week but if US data continues to show negative reports coupled with stronger Euro and GBP reports then the trend could continue.

Ok so what's the deal with the crazy move? Let's see....The French said business confidence was at its strongest levels in 5 years. Being that the French make up the 2nd largest economy for the Euro-Zone, this is pretty big. To add to the Euro fuel, German business confidence surprisingly jumped to a 15 year high! So can someone say interest rate hike? Apparently that's exactly what the few traders that traded over the holidays were saying as they sold off the dollar and drove the Euro and Pound to new highs.

Now before you go and join the crowd, consider this: Volume was very thin over the holidays and as a result there was no one to sell against the rising Euro and Cable. I think we'll see a correction during the course of this week. We are already starting to see some of the retracement and I expect that we'll see more counter movement throughout the week.

On the US front, shopping was crazy throughout this weekend. The word on the street is that consumer shopping has started off on a strong note and could be indicative of a good shopping season. This strong spending will cause a spike in Retail Sales and Consumer Spending especially since salaries have been growing. People have money in their pockets and they're not afraid to use it!

Weekly Bias-O-Meter:

My Bias-O-Meter is still showing a dollar negative trend. It's been like this for 4 straight weeks now.

EUR/USD; GBP/USD= Bullish

USD/CHF; USD/JPY= Bearish

Coming Up:

US Durable Goods

8:30 am ET; 13:30 GMT

Previous= .5%; Forecast= .4%

Consumer Confidence

10:00 am ET; 15:00 GMT

Previous= 105.4; Forecast= 106.4

Existing Home Sales

10:00 am ET; 15:00 GMT

Previous= 6.18M; Forecast= 6.20M

Chart Analysis:

EUR/USD

Whatever the Euro has been doing over the holidays has caused my oscillator to show extreme levels. As a result, I see REVERSAL opportunities. The 4hr stochastics has shown overbought since last Tuesday and the daily stochastics is also in overbought territory. I'm starting to see the formation of a regular bearish divergence on the daily chart so there's a good chance the next move is down. The trick now is to find a suitable entry point. I'm going to hold off until the fast stochastic line actually crosses down below the slow stochastic line.

GBP/USD

Like the Euro, the Cable is telling a similar story. 4 hr stochastics has been showing overbought since Monday of last week and we're now starting to see the formation of a regular hidden divergence on the daily chart. Again, the trick is finding a good entry point and I will also hold off on this one until the fast stochastic line crosses below the slower stochastic line.

USD/CHF

The Swissy has found support at 2000. The pair has been in oversold territory on the 4hr chart since last Tuesday and it looks like a reversal is a good possibility. Unlike the Euro and Cable which are showing divergences, the Swissy is not showing any kind of divergence but its daily stochastics is in oversold territory and looks to be heading back up.

USD/JPY

The Yen got as low as 115.50 and looks to have found support there. Currently it's right at 116.00 and seems to have found new support at the 200 SMA on the daily chart. The 4 hr stochastics has been moving up so it's hard to say whether or not the pair will continue to move up or if it will reverse back down. Things are kind of tricky right now since the holiday trading kind of made the market movements a little weird.

Conclusion:

Thanksgiving trading really threw a bone at the market as the low volume of traders forced the market in a lopsided direction. Now that the rest of the world is back in the market, it will be interesting to see what happens. My personal opinion is that last week's move will be corrected this week but if US data continues to show negative reports coupled with stronger Euro and GBP reports then the trend could continue.

Tuesday, November 21, 2006

Tuesday, November 21, 2006

Thanksgiving is fast approaching and while I'm excited about stuffing my face with an endless supply of delicious home cooked food, there is something even more exciting that is putting a twitch in my trading finger. It's called "Black Friday" and it refers to the one day a year when stores have ridiculous discounts so that the US consumer can start their annual Christmas shopping. This means waking up early, standing outside stores in huge lines, and fighting the mob for all the cool new gadgets stores have to offer. The day after Thanksgiving sparks the start of Christmas which to me could spark a short term growth in consumer spending.

I talked about this a couple months ago but consumer spending has been one of the few areas that are keeping the US economy afloat. We all know housing is dead, but with the shopping season starting, we could see a short term uptrend for the dollar. I expect consumer spending to be big. Gas prices are still relatively cheap and employees are making more, giving them more cash to spend on little Tommy and Katie. I just thought I'd throw out that little point.

In other news, the BOJ minutes were released early this morning and the consensus is that they will not be raising rates until sometime next year. The tone was that the their economy is growing moderately which basically means they are in no hurry to raise their rates. Enough said.

Coming Up:

Again nothing major is coming out, but the BOE minutes will be released and you should definitely give it a read. Also, consumer confidence is coming out at 10 am ET, but I don't think it will cause any movement unless the number is very extreme.

Chart Analysis:

EUR/USD

Ok so the Euro didn't fall as much as I thought it would, but it did make another bounce like I expected. At this point it's hard to say where the Euro will go tomorrow because the 4hr stochastics turned upwards before hitting the oversold region. Daily stochastics is still headed down but I don't see any major resistance levels nearby to justify a move down. The pair has bounced off of 2850 a few times so it could hold once again. It's hard to say at this point. I'm going to hold off on this.

GBP/USD

Like I said yesterday, the Cable moved up to where the 100 SMA is and I think the next move is a bounce down. 4hr stochastics moved briefly out of overbought territory but it headed back up there towards the end of the day today. Since the 9000 level is also where the 100 SMA is on the 4hr chart I think this resistance will hold because of the lack of fundamentals and slow trading week this week. Look for the pair to move back down to 8950.

USD/CHF

So the resistance I mentioned yesterday at the 50 and 100 SMA held its ground and the Swissy made another move back down to 2400. The million dollar question now is whether or not 2400 will hold. Stochastics on both the 4hr and daily chart are both showing more room for selling power but like I said, trading will be kind of dead this week because of the holiday and lack of fundamental reports. My guess is that this pair will hold at 2400 and may range to 2450.

USD/JPY

The Yen did even more consolidating today and I am expecting a breakout at some point in this pair. I think a good play would be to straddle it by looking to buy past 118.50 or sell below 117.50. If the pair breaks one of those levels I think the logical targets would be 119.00 and 117.00 respectively. I think we'll see more tight range trading the rest of the week so this probably won't happen until sometime next week.

Conclusion:

With tomorrow being the day before Thanksgiving, many people will be traveling and trading volume should be pretty low tomorrow. Times like these can be dangerous so be careful if you do trade tomorrow. This will be my last post until next Monday as I will be out of town for the holidays. Have a happy Thanksgiving everyone!

I talked about this a couple months ago but consumer spending has been one of the few areas that are keeping the US economy afloat. We all know housing is dead, but with the shopping season starting, we could see a short term uptrend for the dollar. I expect consumer spending to be big. Gas prices are still relatively cheap and employees are making more, giving them more cash to spend on little Tommy and Katie. I just thought I'd throw out that little point.

In other news, the BOJ minutes were released early this morning and the consensus is that they will not be raising rates until sometime next year. The tone was that the their economy is growing moderately which basically means they are in no hurry to raise their rates. Enough said.

Coming Up:

Again nothing major is coming out, but the BOE minutes will be released and you should definitely give it a read. Also, consumer confidence is coming out at 10 am ET, but I don't think it will cause any movement unless the number is very extreme.

Chart Analysis:

EUR/USD

Ok so the Euro didn't fall as much as I thought it would, but it did make another bounce like I expected. At this point it's hard to say where the Euro will go tomorrow because the 4hr stochastics turned upwards before hitting the oversold region. Daily stochastics is still headed down but I don't see any major resistance levels nearby to justify a move down. The pair has bounced off of 2850 a few times so it could hold once again. It's hard to say at this point. I'm going to hold off on this.

GBP/USD

Like I said yesterday, the Cable moved up to where the 100 SMA is and I think the next move is a bounce down. 4hr stochastics moved briefly out of overbought territory but it headed back up there towards the end of the day today. Since the 9000 level is also where the 100 SMA is on the 4hr chart I think this resistance will hold because of the lack of fundamentals and slow trading week this week. Look for the pair to move back down to 8950.

USD/CHF

So the resistance I mentioned yesterday at the 50 and 100 SMA held its ground and the Swissy made another move back down to 2400. The million dollar question now is whether or not 2400 will hold. Stochastics on both the 4hr and daily chart are both showing more room for selling power but like I said, trading will be kind of dead this week because of the holiday and lack of fundamental reports. My guess is that this pair will hold at 2400 and may range to 2450.

USD/JPY

The Yen did even more consolidating today and I am expecting a breakout at some point in this pair. I think a good play would be to straddle it by looking to buy past 118.50 or sell below 117.50. If the pair breaks one of those levels I think the logical targets would be 119.00 and 117.00 respectively. I think we'll see more tight range trading the rest of the week so this probably won't happen until sometime next week.

Conclusion:

With tomorrow being the day before Thanksgiving, many people will be traveling and trading volume should be pretty low tomorrow. Times like these can be dangerous so be careful if you do trade tomorrow. This will be my last post until next Monday as I will be out of town for the holidays. Have a happy Thanksgiving everyone!

Monday, November 20, 2006

Monday, November 20, 2006

This week is going to be dull. Personally, I am already thinking about the gorgeous turkey that I will be devouring on Thanksgiving. With hardly any economic reports due out this week and the fact that Thanksgiving is on Thursday, I don't expect too many things to happen in the Forex world. Last year I ended up losing 3 straight trades on the 3 days right before Thanksgiving so I will only be taking a trade if I see a really good setup.

I will not be posting on Wednesday-Friday since I will be out of town, and seeing how this is the most traveled holiday (yes even more than Christmas), I am expecting a rather low volume of traders during these days. I highly advise that you take a vacation from trading and enjoy the time off. If you're outside of the US, use this time to maybe re-focus. Review your past trades. Review your current trading systems. Just take a few days to analyze yourself as a trader. This is the perfect time to do so!

My Bias-O-Meter is once again telling me that the dollar is poised for a sell-off. I've been seeing a downtrend for the dollar across the majors for about 3 weeks now. This doesn't necessarily mean that the dollar will be bearish from now on, but it does give me some indication as to where the dollar may be headed in the medium term.

Weekly Bias-O-Meter:

EUR/USD; GBP/USD= Bullish

USD/CHF; USD/JPY= Bearish

Coming Up:

Absolutely nothing! Well not really, but there isn't anything major coming out. The BOJ minutes will be released so you might want to go over that but I don't see anything major coming out tomorrow.

Chart Analysis:

EUR/USD

Am I good or am I great? I said on Thursday that I felt 2800 was a good support and that if the price dipped it would find support at around 2770 which was where the 100 SMA was approaching. I also said that I felt the price would move back to 2850. Like magic, the pair did exactly that and I once again have a big head. I apologize and hope you can bare with me! Deep breath......ok back to reality. After all the bouncing the 2800 is giving us, I think we're going to see a stronger push down this time. With the lack of fundamental reports this week mixed with the Thanksgiving holidays I'm not sure if we'll see that push this week. However, my next target for the Euro is 2750. Stochastics on the 4hr has plenty of room to fall but depending on the movement the pair may just bounce off of 2770 again. We'll have to wait and see.

GBP/USD

Well my trade never got triggered but my thinking was correct. There were a lot of signs pointing towards a reversal to the upside and 8850 looked to be the bottom of before the reversal. The pair has moved nicely and is currently around 8970. My next guess would be for the Cable to retrace down to around 8900 as the 4hr stochastics is showing an extended overbought signal. The 50 SMA on the daily chart is also approaching 8900 so that should be a good support area. Look for a move towards 8900 before another bounce back up.

USD/CHF

I said on Thursday that I felt that 2500 would hold as a good resistance level and after a brief spike, the pair ended up closing back below 2500 on Friday. I targeted 2400 and the pair hit that level today. From the 4hr stochastics point of view it looks like a move up is the next play. However the pair faces resistance at the 50 and 100 SMA on the 4 hr chart which is hovering right above the price at around 2460. Not really sure where this is going.

USD/JPY

Woooweee the Yen is trading tighter than the Ohio State vs. Michigan game was! From my vantage point I'm seeing an ascending triangle on the daily chart. I think a breakout is going to happen soon but it may not happen until after this week. 118.50 will be the level to break. If we see this broken, look for a move to at least 119.00 and maybe even 119.50.

Conclusion:

It's a short week with very few fundamental reports. Look for a lot of spikes and range trading. Be very careful if you trade this week.

I will not be posting on Wednesday-Friday since I will be out of town, and seeing how this is the most traveled holiday (yes even more than Christmas), I am expecting a rather low volume of traders during these days. I highly advise that you take a vacation from trading and enjoy the time off. If you're outside of the US, use this time to maybe re-focus. Review your past trades. Review your current trading systems. Just take a few days to analyze yourself as a trader. This is the perfect time to do so!

My Bias-O-Meter is once again telling me that the dollar is poised for a sell-off. I've been seeing a downtrend for the dollar across the majors for about 3 weeks now. This doesn't necessarily mean that the dollar will be bearish from now on, but it does give me some indication as to where the dollar may be headed in the medium term.

Weekly Bias-O-Meter:

EUR/USD; GBP/USD= Bullish

USD/CHF; USD/JPY= Bearish

Coming Up:

Absolutely nothing! Well not really, but there isn't anything major coming out. The BOJ minutes will be released so you might want to go over that but I don't see anything major coming out tomorrow.

Chart Analysis:

EUR/USD

Am I good or am I great? I said on Thursday that I felt 2800 was a good support and that if the price dipped it would find support at around 2770 which was where the 100 SMA was approaching. I also said that I felt the price would move back to 2850. Like magic, the pair did exactly that and I once again have a big head. I apologize and hope you can bare with me! Deep breath......ok back to reality. After all the bouncing the 2800 is giving us, I think we're going to see a stronger push down this time. With the lack of fundamental reports this week mixed with the Thanksgiving holidays I'm not sure if we'll see that push this week. However, my next target for the Euro is 2750. Stochastics on the 4hr has plenty of room to fall but depending on the movement the pair may just bounce off of 2770 again. We'll have to wait and see.

GBP/USD

Well my trade never got triggered but my thinking was correct. There were a lot of signs pointing towards a reversal to the upside and 8850 looked to be the bottom of before the reversal. The pair has moved nicely and is currently around 8970. My next guess would be for the Cable to retrace down to around 8900 as the 4hr stochastics is showing an extended overbought signal. The 50 SMA on the daily chart is also approaching 8900 so that should be a good support area. Look for a move towards 8900 before another bounce back up.

USD/CHF

I said on Thursday that I felt that 2500 would hold as a good resistance level and after a brief spike, the pair ended up closing back below 2500 on Friday. I targeted 2400 and the pair hit that level today. From the 4hr stochastics point of view it looks like a move up is the next play. However the pair faces resistance at the 50 and 100 SMA on the 4 hr chart which is hovering right above the price at around 2460. Not really sure where this is going.

USD/JPY

Woooweee the Yen is trading tighter than the Ohio State vs. Michigan game was! From my vantage point I'm seeing an ascending triangle on the daily chart. I think a breakout is going to happen soon but it may not happen until after this week. 118.50 will be the level to break. If we see this broken, look for a move to at least 119.00 and maybe even 119.50.

Conclusion:

It's a short week with very few fundamental reports. Look for a lot of spikes and range trading. Be very careful if you trade this week.

Thursday, November 16, 2006

Thursday, November 16, 2006

The dollar rose slightly due to the higher than expected TIC data and Philly Fed Index. However, the gain was held back by a lower CPI (which we already knew was going to happen because of the low PPI number on Tuesday). The GBP retail sales also rose higher than expected. All these factors led to a lackluster day in the majors as the pairs pretty much stayed put.

My Cable trade did not trigger because the pair did not drop low enough. I still think the trade looks good so I will keep it in play. However, the pair bounced off of its 200 SMA on the 4hr chart and I'm not sure if we'll see another drop. Regardless, I will keep the entry the same as stochastics on the daily chart still show a little more room for some selling power and with the 100 SMA also lining up at our entry level of 8800, I think this is the safest place to put a buy order at.

Coming Up:

US Housing Starts

8:30 am ET; 1:30 GMT

Previous= 1.77M; Forecast= 1.68M

Housing has been weak lately and the debate now is whether or not the slump is over. Economists are forecasting another drop so if we happen to see a rise in housing starts (especially a number higher than last month's number) then we should see the dollar rally tomorrow.

Chart Analysis:

EUR/USD

The EUR/USD didn't quite get to 2850 but it did get pretty close. Now the pair has once again dropped back down to 2800 which is also where the 50 SMA is lurking. This pair has tested 2800 several times the last few days and has bounced up each time so this is turning out to be a pretty decent support level. Stochastics on the 4hr chart has reversed and is showing signs for short term selling with the daily stochastics also showing signs for selling. The next support level will be at the 100 SMA on the 4hr which is currently around 2770. At this point I'm not sure where the pair is headed as 2800 has been providing good support while stochastics on both the 4hr and daily charts are showing selling signals. With 2800 being a good support and the 100 SMA not too far below it, my best guess is that this pair will bounce again towards 2850. Since stochastics is showing selling power if the pair drops, it shouldn't drop too much lower than the 100 SMA.

GBP/USD

I'm going to keep my trade idea active but I'm having doubts as to whether the trade will trigger. The Cable has found support at 8850 (the 200 SMA on the 4hr chart) and the 4hr stochastics is showing an upward trend. Not to mention the fact that the today's daily chart candle was a spinning top which gives strong indication of a reversal. I may have missed the boat on this one but I don't want to play it too aggressive. The entry level for my trade is a very safe level and if it does happen to trigger, there is a VERY good chance my trade will win. I'll just have to suck it up if the price just continues to bounce up without taking me along for the ride. If you're feeling aggressive you could buy the pair now (around 8890) and target 8950 and put your stop at 8850.

Trade Idea:

Buy at 1.8800; Stop Loss= 1.8720; Target= 1.8900

USD/CHF

The Swissy has been real quiet lately and is starting to look really ugly. Right now the pair is testing resistance at the 100 SMA on the 4 hr chart and we have another good resistance level at 2500 which is where the 50 and 200 SMA are at on the daily chart. Stochastics on the 4hr chart still show signs for more selling although the slope is moving ever so slowly. I expect to see a drop tomorrow as 2500 is looking to be a very strong resistance point since 2 moving averages are converging at that same level. Unless we see drastic US news tomorrow, I don't expect 2500 to be broken. Look for the pair to drop to 2400.

USD/JPY

The Yen is also looking really ugly as all 3 moving averages on the 4hr chart are looking like multicolored spaghetti strands right now. The pair has found resistance at 118.30 (200 SMA on the 4hr chart) but stochastics is wiring together and isn't giving me a good directional bias. I'll refrain from making any guesses on this one.

Conclusion:

There isn't much going on tomorrow except for the New Housing Starts report. Look for the market to follow the technicals unless the numbers for the new housing report are extreme.

My Cable trade did not trigger because the pair did not drop low enough. I still think the trade looks good so I will keep it in play. However, the pair bounced off of its 200 SMA on the 4hr chart and I'm not sure if we'll see another drop. Regardless, I will keep the entry the same as stochastics on the daily chart still show a little more room for some selling power and with the 100 SMA also lining up at our entry level of 8800, I think this is the safest place to put a buy order at.

Coming Up:

US Housing Starts

8:30 am ET; 1:30 GMT

Previous= 1.77M; Forecast= 1.68M

Housing has been weak lately and the debate now is whether or not the slump is over. Economists are forecasting another drop so if we happen to see a rise in housing starts (especially a number higher than last month's number) then we should see the dollar rally tomorrow.

Chart Analysis:

EUR/USD

The EUR/USD didn't quite get to 2850 but it did get pretty close. Now the pair has once again dropped back down to 2800 which is also where the 50 SMA is lurking. This pair has tested 2800 several times the last few days and has bounced up each time so this is turning out to be a pretty decent support level. Stochastics on the 4hr chart has reversed and is showing signs for short term selling with the daily stochastics also showing signs for selling. The next support level will be at the 100 SMA on the 4hr which is currently around 2770. At this point I'm not sure where the pair is headed as 2800 has been providing good support while stochastics on both the 4hr and daily charts are showing selling signals. With 2800 being a good support and the 100 SMA not too far below it, my best guess is that this pair will bounce again towards 2850. Since stochastics is showing selling power if the pair drops, it shouldn't drop too much lower than the 100 SMA.

GBP/USD

I'm going to keep my trade idea active but I'm having doubts as to whether the trade will trigger. The Cable has found support at 8850 (the 200 SMA on the 4hr chart) and the 4hr stochastics is showing an upward trend. Not to mention the fact that the today's daily chart candle was a spinning top which gives strong indication of a reversal. I may have missed the boat on this one but I don't want to play it too aggressive. The entry level for my trade is a very safe level and if it does happen to trigger, there is a VERY good chance my trade will win. I'll just have to suck it up if the price just continues to bounce up without taking me along for the ride. If you're feeling aggressive you could buy the pair now (around 8890) and target 8950 and put your stop at 8850.

Trade Idea:

Buy at 1.8800; Stop Loss= 1.8720; Target= 1.8900

USD/CHF

The Swissy has been real quiet lately and is starting to look really ugly. Right now the pair is testing resistance at the 100 SMA on the 4 hr chart and we have another good resistance level at 2500 which is where the 50 and 200 SMA are at on the daily chart. Stochastics on the 4hr chart still show signs for more selling although the slope is moving ever so slowly. I expect to see a drop tomorrow as 2500 is looking to be a very strong resistance point since 2 moving averages are converging at that same level. Unless we see drastic US news tomorrow, I don't expect 2500 to be broken. Look for the pair to drop to 2400.

USD/JPY

The Yen is also looking really ugly as all 3 moving averages on the 4hr chart are looking like multicolored spaghetti strands right now. The pair has found resistance at 118.30 (200 SMA on the 4hr chart) but stochastics is wiring together and isn't giving me a good directional bias. I'll refrain from making any guesses on this one.

Conclusion:

There isn't much going on tomorrow except for the New Housing Starts report. Look for the market to follow the technicals unless the numbers for the new housing report are extreme.

Wednesday, November 15, 2006

Wednesday, November 15, 2006

The dollar made pretty decent moves verses the Swissy and Yen but ended up pretty much in place against the Euro. The biggest loser however was the Cable in which the dollar made a very nice rally against it. The GBP showed weak reports during their session and added to the fact that a higher than expected number came out for the US Empire Manufacturing Index, traders placed their bets that the dollar is still the stronger currency.

The FOMC minutes showed that the Fed is still worried about inflation and the slowing economy but the overall sentiment is that the Fed will still keep rates steady for the remainder of 2007.

After a few days of back and forth dollar movement, stochastics on the daily charts have been wishy washy. Now the stochastics seems to be resuming its trend for a dollar rally. I expect the trend to continue until the daily stochastics on the majors reach extreme levels again so unless we see devastating news for the dollar, watch for the Greenback rally to continue for a few more days.

Coming Up:

GBP Retail Sales

4:30 am ET; 9:30 GMT

Previous= -0.4%; Forecast= 0.2%

The forecast shows a possible increase in retail sales. With the weak GBP data out today, this number will be important for the Cable. If the retail sales happens to come out lower than the previous number of -0.4%, watch for a big drop in the Cable.

US Core CPI

8:30 am ET; 13:30 GMT

Previous= 0.2%; Forecast= 0.2%

PPI came out lower than forecast which means that we should also be seeing a lower CPI number. If for some reason CPI comes out higher than expected, I think the dollar will rally. This number will have to be fairly big as traders will also probably want to wait for the TIC data and Industrial Production report due out later in the day.

US TIC Data

9:00 am ET; 14:00 GMT

Previous= 116.8B; Forecast= 63.0B

Anything lower than 63.0B will cause the dollar to drop like a rock. TIC data is important because it basically funds our deficit so a lower than expected number will crush the dollar.

US Industrial Production

9:15 am ET; 14:15 GMT

Previous= -0.6%; Forecast= 0.2%

Chart Analysis:

EUR/USD

Yesterday I said that we would see another bounce to 2850 and I hold firm to that claim. The Euro once again bounced off of 2800 and is currently at 2824. Stochastics on the 4hr chart is headed up with plenty of room for buying power so I expect the pair to reach 2850 and maybe even 2870. On the daily chart, stochastics is once again sloping down so we still have plenty of long term selling power. After the pair moves up to 2850-2870, we could see some of this selling power tomorrow.

GBP/USD

Yesterday I said the Cable was showing an extended period of oversold in the 4hr stochastics and with another big drop today, that period has been extended even longer. To top it off, the pair has found support at the 200 SMA on the 4hr and the 50 SMA on the daily chart. I am seeing strong technical signs that this pair will rally tomorrow. Stochastics on the daily chart is also beginning to enter the oversold category which is also another sign that this pair will move up.

Trade Idea:

Buy at 1.8800; Stop Loss= 1.8720; Target= 1.8900

USD/CHF

I said that the Swissy would reach 2500 if it could break 2450 and that's exactly what it did. Now the pair has bounced back down and is currently resting on its 50 SMA on the 4hr chart. I'm not clear on the direction for this pair tomorrow but if I play the correlation rule, I would expect this pair to go down since I believe that the Euro will rally tomorrow. My best guess is that the pair will move down near 2400.

USD/JPY

Unlike the Swissy, the Yen shows a clearer sign that it will drop. The 4hr stochastics is reading overbought and I think the pair can go down to 117.50. However it faces some resistance along the way as the 50 and 100 SMA stand in between the current price and the 117.50 level.

Conclusion:

The market is full of economic reports tomorrow so we should see a pretty exciting day once again. Since we have 3 major US reports, we will see the most movement if they all line up, whether they are all positive or negative.

The FOMC minutes showed that the Fed is still worried about inflation and the slowing economy but the overall sentiment is that the Fed will still keep rates steady for the remainder of 2007.

After a few days of back and forth dollar movement, stochastics on the daily charts have been wishy washy. Now the stochastics seems to be resuming its trend for a dollar rally. I expect the trend to continue until the daily stochastics on the majors reach extreme levels again so unless we see devastating news for the dollar, watch for the Greenback rally to continue for a few more days.

Coming Up:

GBP Retail Sales

4:30 am ET; 9:30 GMT

Previous= -0.4%; Forecast= 0.2%

The forecast shows a possible increase in retail sales. With the weak GBP data out today, this number will be important for the Cable. If the retail sales happens to come out lower than the previous number of -0.4%, watch for a big drop in the Cable.

US Core CPI

8:30 am ET; 13:30 GMT

Previous= 0.2%; Forecast= 0.2%

PPI came out lower than forecast which means that we should also be seeing a lower CPI number. If for some reason CPI comes out higher than expected, I think the dollar will rally. This number will have to be fairly big as traders will also probably want to wait for the TIC data and Industrial Production report due out later in the day.

US TIC Data

9:00 am ET; 14:00 GMT

Previous= 116.8B; Forecast= 63.0B

Anything lower than 63.0B will cause the dollar to drop like a rock. TIC data is important because it basically funds our deficit so a lower than expected number will crush the dollar.

US Industrial Production

9:15 am ET; 14:15 GMT

Previous= -0.6%; Forecast= 0.2%

Chart Analysis:

EUR/USD

Yesterday I said that we would see another bounce to 2850 and I hold firm to that claim. The Euro once again bounced off of 2800 and is currently at 2824. Stochastics on the 4hr chart is headed up with plenty of room for buying power so I expect the pair to reach 2850 and maybe even 2870. On the daily chart, stochastics is once again sloping down so we still have plenty of long term selling power. After the pair moves up to 2850-2870, we could see some of this selling power tomorrow.

GBP/USD

Yesterday I said the Cable was showing an extended period of oversold in the 4hr stochastics and with another big drop today, that period has been extended even longer. To top it off, the pair has found support at the 200 SMA on the 4hr and the 50 SMA on the daily chart. I am seeing strong technical signs that this pair will rally tomorrow. Stochastics on the daily chart is also beginning to enter the oversold category which is also another sign that this pair will move up.

Trade Idea:

Buy at 1.8800; Stop Loss= 1.8720; Target= 1.8900

USD/CHF

I said that the Swissy would reach 2500 if it could break 2450 and that's exactly what it did. Now the pair has bounced back down and is currently resting on its 50 SMA on the 4hr chart. I'm not clear on the direction for this pair tomorrow but if I play the correlation rule, I would expect this pair to go down since I believe that the Euro will rally tomorrow. My best guess is that the pair will move down near 2400.

USD/JPY

Unlike the Swissy, the Yen shows a clearer sign that it will drop. The 4hr stochastics is reading overbought and I think the pair can go down to 117.50. However it faces some resistance along the way as the 50 and 100 SMA stand in between the current price and the 117.50 level.

Conclusion:

The market is full of economic reports tomorrow so we should see a pretty exciting day once again. Since we have 3 major US reports, we will see the most movement if they all line up, whether they are all positive or negative.

Tuesday, November 14, 2006

Tuesday, November 14, 2006

Let me first warn you that I will once again be holding my shoulders high because for the 2nd day in a row, every single one of my chart analysis predictions came true! Cmon, you gotta admit that you feel the same way whenever you make correct market predictions! It's perfectly natural, and if you were correct in your market analysis' then I commend you and pat you on the back.

Before I delve into the fundamentals, let me first recap the Yen trade from yesterday. I had 2 options. One was to short at market (which was at 118.12) or at 118.00. The target was 117.50 and the stop was 118.50. The trade ended up hitting my target early last night and netted 62 pips if you shorted at market, and 50 pips if you shorted at 118.00.

Now for the fundamentals. US PPI was weaker than expected coming in at -1.6% compared to the -0.3% forecast. This means that inflation experienced by wholesalers is relatively low. As a result we should also see a lower CPI report on Thursday since wholesalers won't have to pass on any of their expenses onto the consumer. This weak PPI report caused an initial drop for the dollar but the move was quickly countered by the Retail Sales report. The Retail Sales report also came in lower than expected but this was due to 2 things that traders already have factored in their minds. The first is the lower gas prices. Because gas prices have been so cheap, sales have dropped like a rock, falling 6%. The 2nd is the fall in furniture sales. Well we all know that housing has been crappy lately so it's no big surprise that if housing sales have been slumping, so should furniture sales. Because these 2 things are already assumed, the actual number doesn't seem that bad. When you take away those 2 groups, retail sales actually rose 0.4%. This gave some support for the Greenback and kept it from falling too much.

Coming Up:

US Empire Manufacturing Index

8:30 am ET; 1:30 GMT

Previous= 22.9; Forecast= 15.0

US FOMC Minutes

2:00 am ET; 19:00 GMT

Pay close attention to statements regarding inflation and the slowing economy. More importantly, pay attention to what Fed says they will do regarding these issues.

Chart Analysis:

EUR/USD

Although we had some volatile moves in the EUR/USD today, there hasn't been a clear direction. As a result, stochastics on the 4hr chart isn't really giving me a clear signal. The pair has found support at 2800 again and with the 50 SMA also hovering around that level it should make decent support. My best guess is that the pair will once again bounce off of 2800 and make another run towards 2850 but I'm not entirely confident about it. Stochastics is still heading up on the 4hr chart but it's moving slow so I'm not sure if that trend will continue. We'll have to wait and see.

GBP/USD

The Cable has been under a lot of selling pressure lately and I think we'll see a retracement soon. Look for the pair to rise to 9030-9050 (around the 50 SMA on the 4hr chart) in the short term. On a longer term outlook, I think the pair will eventually drop to 8900. Stochastics on the daily chart has a nice downtrend and there is still plenty of room for the pair to fall.

USD/CHF

The Swissy is once again testing resistance at 2450 (50 SMA) and 4hr stochastics is making its way down. I think the pair will go to at least 2400 but after that I'm not sure if the pair will have enough juice to keep pushing forward. If the pair reverses and breaks 2450, look for the Swissy to go to 2500 which is where the 100 SMA is at.

USD/JPY

I think the Yen will make a run towards 117.00. I'm not sure if it will actually hit or not but it should get close. After that look for the pair to bounce back up to 117.50 again. Stochastics on the 4hr chart shows a little more room for selling but not much so I don't expect it to drop much further.

Conclusion:

There are less economic reports tomorrow but still be on the lookout for some nice movement, especially after the FOMC minutes. Tomorrow should be another exciting day so be ready!

Before I delve into the fundamentals, let me first recap the Yen trade from yesterday. I had 2 options. One was to short at market (which was at 118.12) or at 118.00. The target was 117.50 and the stop was 118.50. The trade ended up hitting my target early last night and netted 62 pips if you shorted at market, and 50 pips if you shorted at 118.00.

Now for the fundamentals. US PPI was weaker than expected coming in at -1.6% compared to the -0.3% forecast. This means that inflation experienced by wholesalers is relatively low. As a result we should also see a lower CPI report on Thursday since wholesalers won't have to pass on any of their expenses onto the consumer. This weak PPI report caused an initial drop for the dollar but the move was quickly countered by the Retail Sales report. The Retail Sales report also came in lower than expected but this was due to 2 things that traders already have factored in their minds. The first is the lower gas prices. Because gas prices have been so cheap, sales have dropped like a rock, falling 6%. The 2nd is the fall in furniture sales. Well we all know that housing has been crappy lately so it's no big surprise that if housing sales have been slumping, so should furniture sales. Because these 2 things are already assumed, the actual number doesn't seem that bad. When you take away those 2 groups, retail sales actually rose 0.4%. This gave some support for the Greenback and kept it from falling too much.

Coming Up:

US Empire Manufacturing Index

8:30 am ET; 1:30 GMT

Previous= 22.9; Forecast= 15.0

US FOMC Minutes

2:00 am ET; 19:00 GMT

Pay close attention to statements regarding inflation and the slowing economy. More importantly, pay attention to what Fed says they will do regarding these issues.

Chart Analysis:

EUR/USD

Although we had some volatile moves in the EUR/USD today, there hasn't been a clear direction. As a result, stochastics on the 4hr chart isn't really giving me a clear signal. The pair has found support at 2800 again and with the 50 SMA also hovering around that level it should make decent support. My best guess is that the pair will once again bounce off of 2800 and make another run towards 2850 but I'm not entirely confident about it. Stochastics is still heading up on the 4hr chart but it's moving slow so I'm not sure if that trend will continue. We'll have to wait and see.

GBP/USD

The Cable has been under a lot of selling pressure lately and I think we'll see a retracement soon. Look for the pair to rise to 9030-9050 (around the 50 SMA on the 4hr chart) in the short term. On a longer term outlook, I think the pair will eventually drop to 8900. Stochastics on the daily chart has a nice downtrend and there is still plenty of room for the pair to fall.

USD/CHF

The Swissy is once again testing resistance at 2450 (50 SMA) and 4hr stochastics is making its way down. I think the pair will go to at least 2400 but after that I'm not sure if the pair will have enough juice to keep pushing forward. If the pair reverses and breaks 2450, look for the Swissy to go to 2500 which is where the 100 SMA is at.

USD/JPY

I think the Yen will make a run towards 117.00. I'm not sure if it will actually hit or not but it should get close. After that look for the pair to bounce back up to 117.50 again. Stochastics on the 4hr chart shows a little more room for selling but not much so I don't expect it to drop much further.

Conclusion: