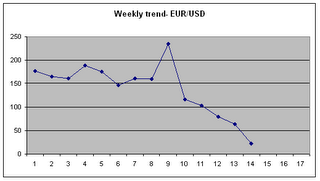

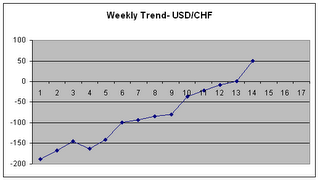

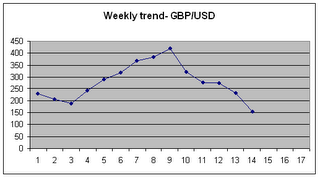

Each week I am going to determine a “bias” for select pairs that I am following. This will give me a general overview of the overall trend. To do this I am going to be using a method that I pulled from the Vegas Tunnel Method. I stumbled onto his system not too long ago, and I really love the way he uses momentum to get a directional bias.

Basically, I will be looking at a weekly chart plotted with a 5 SMA and a 21 EMA.

I calculate the difference between these 2 moving averages and plot this value into a spreadsheet. I do this for several candles (weeks) and basically look to see if this value is growing or shrinking.

If the value is growing, then I know that momentum is bullish.

If the value is shrinking, then I know the momentum is bearish.

Keep in mind, as with every moving average, this is still delayed. An optimal reading would be to see a pair have 2 consecutive weeks of either bullish momentum or bearish momentum.

I’ve been plotting this data for a while now and have come up with a few graphs. Here are the weekly momentum trends for the 4 majors (the last point marks the week of October 1, 2006):

By looking at these line graphs I can get a basic momentum trend for each pair. For a full reading on Vegas’ Tunnel Method, check out his website at www.tunneltrading.com

I will give each pair a rating on my Bias-O-Meter based on this momentum and other factors I find.

These will be posted once a week on Mondays.

In the next section I will go into a little detail on the upcoming economic events. I’ll briefly describe (in order of occurrence) what the economic report is, what the consensus is, and what it might possibly do to the market. I’m not a deep analysis kind of person but it will help outline my thoughts on these events.

The following section will list any current trades I’m in and any trades I have recently closed. This is mainly for track record keeping purposes so that I can actually see if what I am doing is working.

The last section will be a chart analysis on the 4 majors. I’ll basically give a snapshot of where the pairs are trading and list any trade ideas I see. Basically it will be a like a picture book of how I come up with trades and why I think they will work.

I will still be mentioning the Alba system because it’s such a simple, yet profitable system. However, because it doesn’t give us as many trading opportunities (it only works on the EUR/USD), this section will be brief and I’ll simply give an update if anything has happened regarding Alba trades.

Overall, I think this outline will not only benefit me, but will hopefully help anyone who reads the posts. I named my blog “Pippin Ain’t Easy” because staying focused and disciplined is a lot harder than it sounds. This blog will keep me on track and hopefully will encourage you all to do the same. So with that said, lets bag us some pips!

Happy trading!

-BP

No comments:

Post a Comment